CORPUS CHRISTI, Texas — Portland residents 3NEWS spoke with Wednesday said they voted against the Gregory-Portland ISD's Bond 2022 because they thought it would increase the taxes on their property value.

District superintendent Michelle Cavazos said this wouldn't have been the case, but understands why people may have been confused.

"In 2019, the legislature passed a law where, on school-bond issues only, school districts have to put on 'This is a tax increase,' ” Cavazos said. "So that’s confusing in a district like ours where we’re not increasing the total tax rate."

For that reason, Cavazos said the district was intentional about trying to explain to residential taxpayers how the bond would work, and how money flows through the district.

"As a district, we set the tax rate, not the appraisal of our property values," she said.

The point of the bond, officials said, was to try and get as much done while the district is in a position to maximize its spending.

"We’re at a very unique time for us as a school district where we can go out for bonds without increasing our total tax rate, and it’s a short window of time that we as a district are trying to capitalize on so that," Cavazos said.

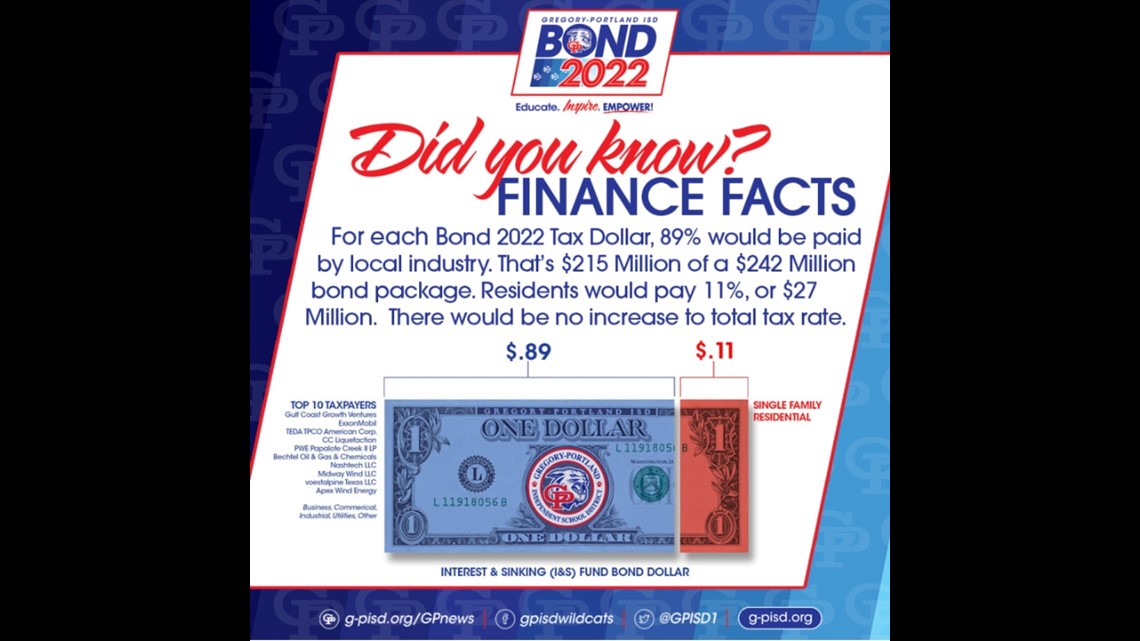

But to understand why the board sees this as the time to ask for taxpayers for $242,590,926, it's important to understand how the district's finances work.

And it's not an easy thing to understand, not even to school board members.

“It’s quite a wake-up call when you understand the complexity of the school finance system and the way that wealth equalization works in the state," said board president Tim Flinn in a news release Tuesday night after the bond was defeated.

Paying the bills

G-PISD is able to operate by drawing funds from two sources: its Maintenance and Operations (M&O) fund, and its Interest and Sinking (I&S Debt Service) fund. The district can only pay certain bills out of specific funds.

The Maintenance and Operations fund pays for the district's basic daily operations such as the light bill and payroll, Cavazos said. However, there are agreements that the district entered into with some of its industrial neighbors in order to incentivize them to set up shop within the G-PISD borders.

Companies are entitled to tax breaks for a 10-year period, which limits the amount of money that goes into G-P's maintenance and operations funds, and this has its advantages and disadvantages.

"Gregory-Portland is now considered a property-wealthy district," Cavazos said. "In the past – about a decade-ish ago, we were on the opposite side of the spectrum."

Chapter 49 of the Texas Education Code aims to level the playing field between wealthy and less prosperous schools. Districts can keep $6,160 of the tax money collected per student, but because G-P's tax base is primarily industrial, it raises more than that just that $6K.

So G-P, as a wealthier district, must "recapture," or give the state money the extra money to redistribute to less fortunate districts. This is why Chapter 49 is better known as the "Robin Hood Law."

"We send (money) once at the beginning of the year," she said. "So this year, it’s not in the millions, yet. However, it will start to exponentially grow in the next several years to be in the multimillion dollars."

But the interest and sinking fund isn't affected by the tax breaks. It still gets 100 percent of the tax money it is due in order to finance fixes to the district's facilities, and its where bond money comes in.

COVID chain reaction

Bonds are used for building improvements and new construction, but projects that are currently being built with Bond 2020 money ended up costing more, because of the economic situation brought on by the COVID-19 pandemic, Cavazos said.

"Prices on those projects in Bond 2020 were estimated at pre-COVID costs, and then the inflation -- and construction costs have gone up exponentially," she said.

So Bond 2022's Proposition A had three reimbursement resolutions built-in, which would have helped pay overrun costs from Bond 2020's Agricultural Science Facility, the Early Childhood Center and its All-Purpose Practice Facility.

It's an overrun of about $30 million that will have to come out of the interest and sinking funds.

"Should we not be able to access those I&S -- interest and sinking -- funds, at some point we’ll need to use maintenance and operations dollars to meet those needs, which is where we’ll be making larger and larger recapture payments, which then impacts how much we’re able to spend on our day-to-day operations," she said.

$30 million doesn't sound like a lot when the district is talking in sums of more than $200 million, but Cavazos said that when you consider that the district's 720-730 employees are paid with 80-85 percent of that money, it puts it into perspective.

"$30 million would run our district for about 6 months," she said.